SpareRoom Statistics

SpareRoom has a huge amount of data on UK rentals, from average rents to supply and demand stats and more. Check back regularly for up to date stats, insights and analysis on what's happening in the market.

UK Rental Market Latest

UK lodger rental supply now in decline

February 2026 - After four consecutive years of growth in the number of households offering rooms to lodgers, lodger room ads decreased in January 2026, falling 2.5% year on year, according to new data from flatshare site SpareRoom.

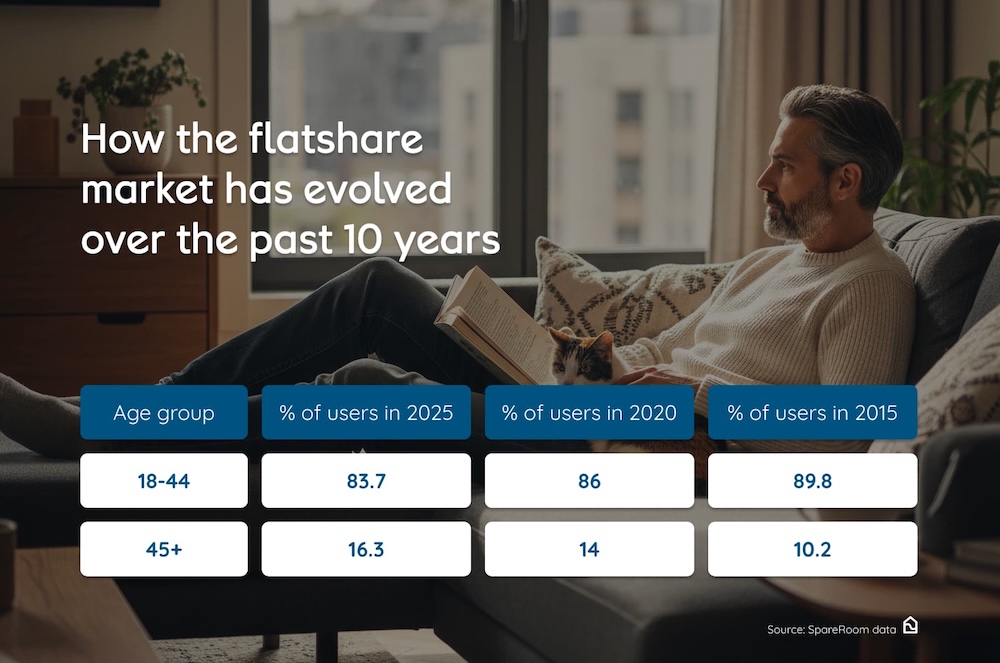

Read moreFlatsharers are getting older

January 2026 - Steep increases in UK room rents are diminishing savings and keeping older renters in shared homes for longer, while creating a barrier to entry for younger renters, according to new data from flatshare site SpareRoom. As a result, under 35s in the flatshare market are in decline while those aged 35+ are rising.

Read moreSpareRoom Rental Index

Recent rental market stories

-

UK rents stable but unaffordable and cheaper areas surge

- <January> 2026

The steepest room rent rises have been concentrated in Scotland, northern England, and the Midlands, according to Q4 2025 rental index data from flatshare site SpareRoom. And with the exception of Liverpool, major cities are notably absent from the list of highest risers, with towns and smaller cities far more likely to feature.

-

Renter crisis deepens as London rents remain stubbornly high

- <January> 2026

London's average room rent saw a year-on year decrease of 0.9% in Q4 2025, and is now £985 per month, according to rental index data from flatshare site SpareRoom. The cheapest postcode area (SE), where the average rent is £958 per month, has seen the highest year-on-year average rent increase (+1.2%).

-

Rents stubbornly high in 2025; supply under threat in 2026

- <January> 2026

After years of pressure on the rental market - the prolonged hangover of a record spike in demand after the pandemic, which forced up UK average rents by 34% and London rents by 38% in just four years - rent rises were subdued throughout 2025.

-

Wales rents rising three times faster than UK

- <December> 2025

Room rents in Wales have risen 40% over the past five years - from £419 to £586 per month - as rents in the UK have risen 28%, according to data from flatshare site SpareRoom. The result is flatsharers now need to 'find' an extra £167 per month, or £2,004 per year, to cover their monthly rent

-

Slowdown in UK rental supply growth as households letting to lodgers stall

- <December> 2025

Growth in the number of households offering rooms to lodgers has slowed significantly in the past year, despite the high cost of living stretching household budgets, reports flatshare site SpareRoom.

-

Workers serving London can't afford to live there

- <November> 2025

Londoners earning the National Living Wage of £12.21 per hour would have to work 63 hours per week - not far off two full-time jobs - to keep within affordability guidelines and spend no more than 30% of their wages on housing costs

-

Renters are 'flathugging' and avoiding contact with landlords

- <November> 2025

"Over half (56%) of UK renters are 'flathugging': they're staying put in their current rental properties despite wanting to move."

-

Renters' Rights Bill gets Royal Assent

- <October> 2025

On Monday 27 October 2025, the Renters' Rights Bill received Royal Assent and entered into law, becoming the Renters' Rights Act 2025. The Act introduces the biggest package of reforms to the private rented sector in England in nearly 40 years.

-

£30k+ income needed to affordably rent a room

- <October> 2025

Spending less than 30% of gross income on rent is no longer an attainable affordability threshold for many under 30s, according to new data from flatshare site SpareRoom.

-

UK room rents hit record highs

- <October> 2025

Renting a room in the UK now costs £753 per month on average which - although only an increase of 0.8% on the previous year - is the highest figure on record

-

London room rents rise 37% in five years

- <October> 2025

Renting in a shared household is the cheapest way to live in London but, with room rents up 37% in just five years, it's also increasingly unaffordable, reports flatshare site SpareRoom.

-

Gender rent gap: housing affordability crisis worse for women

- <September> 2025

Rents are now so unaffordable 51% of flatsharers have relied on some form of loan, credit, advance or a second income stream to help pay their rent in the past year, but it's women who are more likely to be 'rent burdened' than men.

-

Scotland rents: Steepest rises in Stirling; demand highest in Glasgow city

- <September> 2025

At £823 per month, Edinburgh is now the second most expensive UK city in which to rent a room, beaten only by London.

-

Wales rents: Steepest rises in Rhyl; demand highest in Bridgend

- <September> 2025

Seaside town Rhyl and rural market town Carmarthen top the list of highest rent increases in Wales since 2019.

-

Rental supply crisis worse in UK towns than cities

- <September> 2025

The UK's rental supply crisis is now most acute in towns as more renters are priced out of cities, according to Q2 2025 demand data from flatshare site SpareRoom.

-

Rents outstrip budgets in UK towns and cities with biggest affordability gaps

- <August> 2025

A comparison of renters' budgets with average rents puts three suburban towns - Twickenham, Stourbridge and Barnet - top of the most unaffordable areas.

-

UK rental market still suffering after effects of pandemic in 2025

- <July> 2025

The pandemic had a chaotic and lasting impact on the UK rental market. After restrictions on movement were finally lifted from mid 2021 there was a rush to secure rented accommodation.

-

Living costs at top universities differ by up to £11K

- <July> 2025

Students know London is the most expensive city in the UK to live in, but may be unaware of the dramatic differences between rents in other university towns and cities.

-

It's time to raise the rent a room scheme threshold

- <July> 2025

People who rent out furnished rooms in their homes to lodgers can currently earn up to £7,500 per year - equivalent to £625 per month - tax free under the Rent a Room scheme.

-

UK room rents stable, but rising in Wolverhampton, Southend and York

- <July> 2025

Room rents continued to show signs of stabilisation in Q2: UK rents rose 0.9% year on year to £748 per month and London rents now average £980

-

London room rents 'stable, not affordable'

- <July> 2025

London room rents have fallen marginally 0.4% year on year to £980 per month, but strong, sustained demand is preventing any significant decreases.

-

Priced-out flatsharers swap city life for seaside and suburbia

- <June> 2025

Searches by renters reveal swelling interest in suburbia, as well as coastal, commuter and market towns, as more are priced out of major cities and hybrid working endures.

-

Rental supply still rising despite landlord concerns over Renters'

Rights Bill

- <June> 2025

So far, supply in the room rental market remains largely unaffected by the Renters' Rights Bill, according to flatshare site SpareRoom, with January 2025 the highest month for flatshare ads in four years.

-

As the rent burden weighs heavy, 44% wonder if they'll ever own

homes

- <May> 2025

A new survey of 6,524 renters by flatshare site SpareRoom reveals expectations around homeownership and, while 56% believe they will be able to buy property at some point, 14% don't think they'll ever get on the property ladder, and 30% are unsure.

-

Mind the rent gap: all rise on the Elizabeth line

- <May> 2025

Three years since services began, and two years since the full route opened, new data from flatshare site SpareRoom reveals the Elizabeth line has redefined London's commuter belt, turbocharging rental growth and transforming once-overlooked spots into high-demand areas.

-

Lower demand for rooms among priced-out Londoners causes 1% drop in

rents

- <April> 2025

New data from SpareRoom's Q1 2025 Rental Index shows London room rents have fallen 1% year on year and now average £982 per month. Meanwhile, suburban areas are seeing high demand from renters.

-

Lower demand for rooms in London and Birmingham helps rents to

fall

- <April> 2025

New data from SpareRoom's Q1 2025 Rental Index shows London room rents have fallen 1% year on year and now average £982 per month. Meanwhile, suburban areas are seeing high demand from renters.

-

Half of UK flatsharers now have no access to living rooms

- <April> 2025

Almost half (49%) of 2,000+ renters living in shared homes, surveyed by flatshare site SpareRoom, say the living room in their current home is now being used as a bedroom.

-

Where should Londoners be searching for rooms to rent?

- <March> 2025

Average rents in London have just fallen for a fourth consecutive quarter - dropping by 2% from £1,015 in Q4 2023 to £993 per month in Q4 2024

-

Too many renters, not enough rooms in Smethwick, Solihull and

Stockport

- <March> 2025

New data from flatshare site SpareRoom reveals the areas in the UK where demand for rooms to rent is highest.

-

Surge in Homeowners Seeking Lodgers in UK Towns and Villages as

Cost of Living Bites

- <February> 2025

Amid rising living costs and mortgage rate increases, more homeowners are finding ways to supplement their incomes by renting out spare rooms in their homes.

-

Boomer to spareroomer: the rise of the older flatsharer

- <February> 2025

Those in their late 20s and early 30s still dominate the flatshare market, but older age groups are the fastest-growing demographics looking for housemates and rooms to rent in shared homes.

-

UK rental market faces supply crisis as landlords plan to exit

rental sector

- <February> 2025

A record number of landlords (88%) have no confidence in the current private rental sector, a figure that increases to 90% in London.

-

Noisy Flatmates? Download SpareRoom's Pre-Nap agreement

- <December> 2024

According to new research from SpareRoom, the UK's number one flatsharing site, a whopping four in five renters have their sleep disrupted by flatmates at least once a week.

-

Rental supply and demand returns to pre-pandemic levels

- <December> 2024

New data from SpareRoom reveals that the ratio of supply and demand of rooms to rent are finally returning to pre-pandemic levels after five years.

-

Renters' monthly budgets not enough to keep up with rising rent

costs

- <August> 2024

New data from SpareRoom shows the stark difference between what renters budget every month for rent vs the actual cost of their rent.

-

Average London rent up 32% in 5 years

- <August> 2024

New data from SpareRoom shows London rents have increased by an average of 32% in the past five years.

-

Up and Coming UK Rental Hotspots

- <May> 2024

The top ten biggest ‘climber’ locations tend to be between 7-11 miles from Central London, highlighting a growing demand for properties further from the Capital’s centre. Interestingly they’re also some of the cheapest areas to rent in the capital

-

Increase in homeowners taking in lodgers

- <January> 2024

Data from the UK’s leading flatshare site, SpareRoom, reveals that there has been a huge rise in homeowners taking in lodgers. Comparing January 2024 with January 2021 there has been an 89% increase in new people taking in lodgers.

-

Rebalancing the rental market

- <December> 2023

Demand for rental properties has soared, yet supply is falling. Combine that with high inflation and rising interest rates and it means record high rents. Renters are struggling, and landlords are leaving the market.

-

London becomes a ‘no grad zone’

- <September> 2023

Average room rents in London & surrounds are at a record high, reaching a staggering £1,013 in August 2023. Data reveals that London is now entirely unaffordable to graduates, thanks to sky-high rents.

-

Nearly three quarters of renters are thinking of moving to escape

high rents

- <September> 2023

New data from SpareRoom has revealed just under three quarters (72%) of renters are either actively looking (46%) to move to a new area or are considering it (26%), due to record high

-

Rental market shows signs of improvement

- <September> 2023

In July, the ratio of active renters searching compared to rooms available in the UK was 5.6, compared to 6.2 in July 2022. In London it was 4.9, compared to 6 at the same point last year.

-

One in Six Renters Working More Than One Job

- <July> 2023

17% of renters in the UK say they now have to work more than one job, with two thirds of those (67%) doing so to be able to afford their rent

-

One In Three Renters Severely Rent Burdened

- <May> 2023

81% of renters in the UK now spend more than 30% of their take home pay on rent

-

Rental Crisis Putting Lives On Hold

- <March> 2023

UK renters are being forced to delay personal and professional milestones due to rental market chaos - with rents and demand at all time highs, and supply at near 10 year low.